Lock in your rate

5.00% APY1 for our 1-year CD is a big deal. Available for a limited time only.

Life's too short for boring finances.

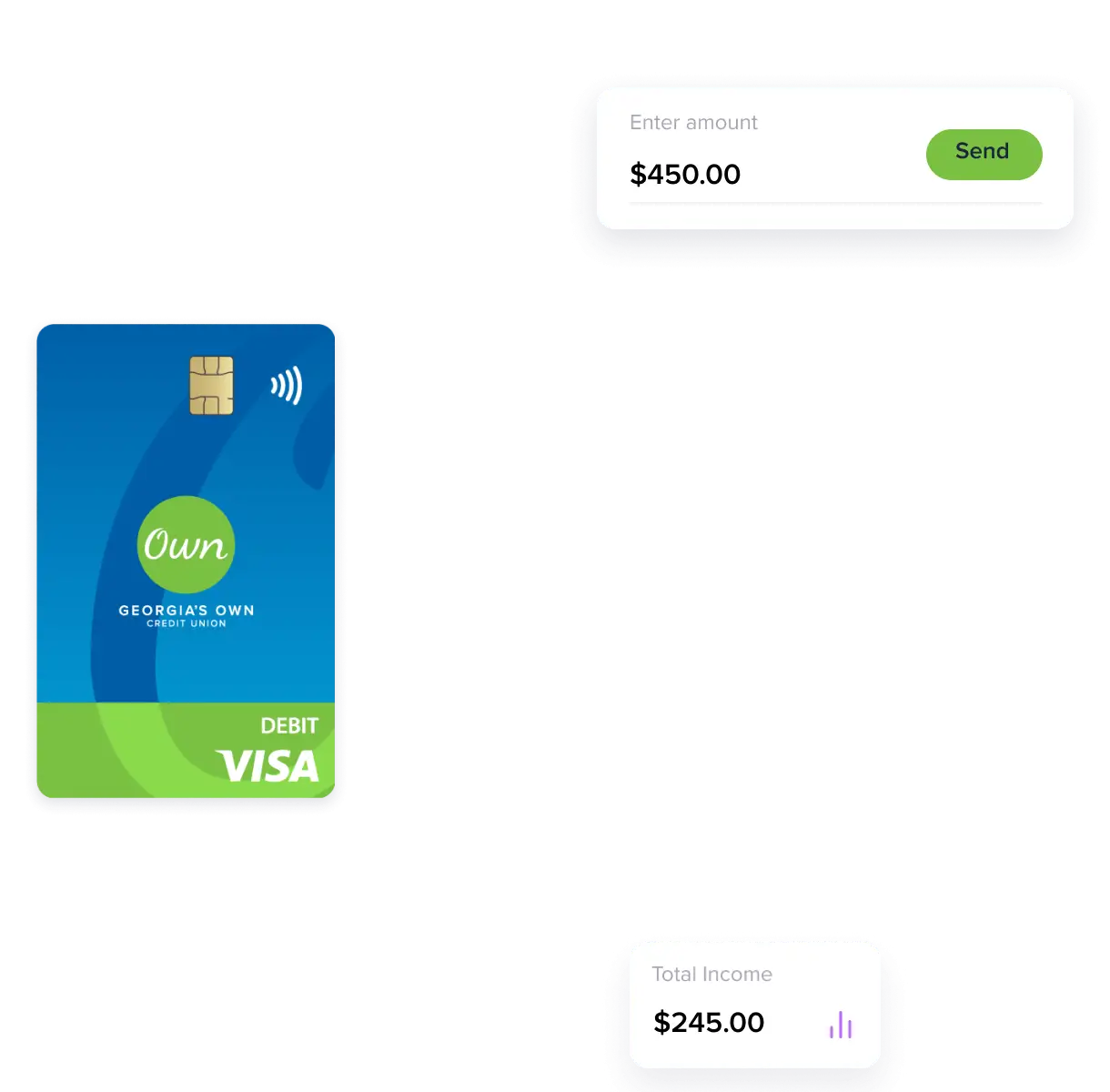

Get .25% off of your rate when you use Carfinder

Check out faster with contactless payments

Your money's always on hand with our mobile banking app

Modern banking you can trust

We’re a cooperative. We’re owned by our members, and we’re backed by the NCUA. That means you get all the benefits of a regular bank, along with better rates and lower (or no) fees.

Learning Center

Go beyond banking with resources and news to learn how to make informed financial decisions.

5 money tips for new college graduates

How to avoid fraud with P2P and A2A transfers

How to budget during inflation

1APY = Annual Percentage Yield. APY valid from April 1, 2024 through April 30, 2024 and is available on our Certificate of Deposit Monthly and Certificate of Deposit Interest Compounded products. Promotional APY assumes interest will remain on deposit until maturity. The minimum opening deposit required to earn the advertised APY is $500. Penalty applies for early withdrawal. Fees may reduce earnings on an account. Offer is not available on business deposits and may be withdrawn without notice.